- BitcoinZella

- Posts

- Macro risk, AI bubbles, and BlackRock flows keep Bitcoin on edge for 2026

Macro risk, AI bubbles, and BlackRock flows keep Bitcoin on edge for 2026

Bitcoin trails stocks and gold while AI bubble risk, liquidity shifts, and whale flows build in the background. You need clear rules for drawdowns, position size, and buy zones.

What we will talk about today...

BlackRock shifts Bitcoin and Ether to Coinbase as traders watch next move

AI bubble risk threatens Bitcoin in 2026

Macro drag makes Bitcoin look like 2019

Cowen urges focus on process over fast altcoin trades

BlackRock resumed deposits after Christmas, moving large BTC and ETH blocks to Coinbase. Flows raise questions for short term price direction and ETF strategy.

[New deposits]: Onchain trackers show more than 3,300 BTC and over 17,000 ETH sent to Coinbase in recent days.

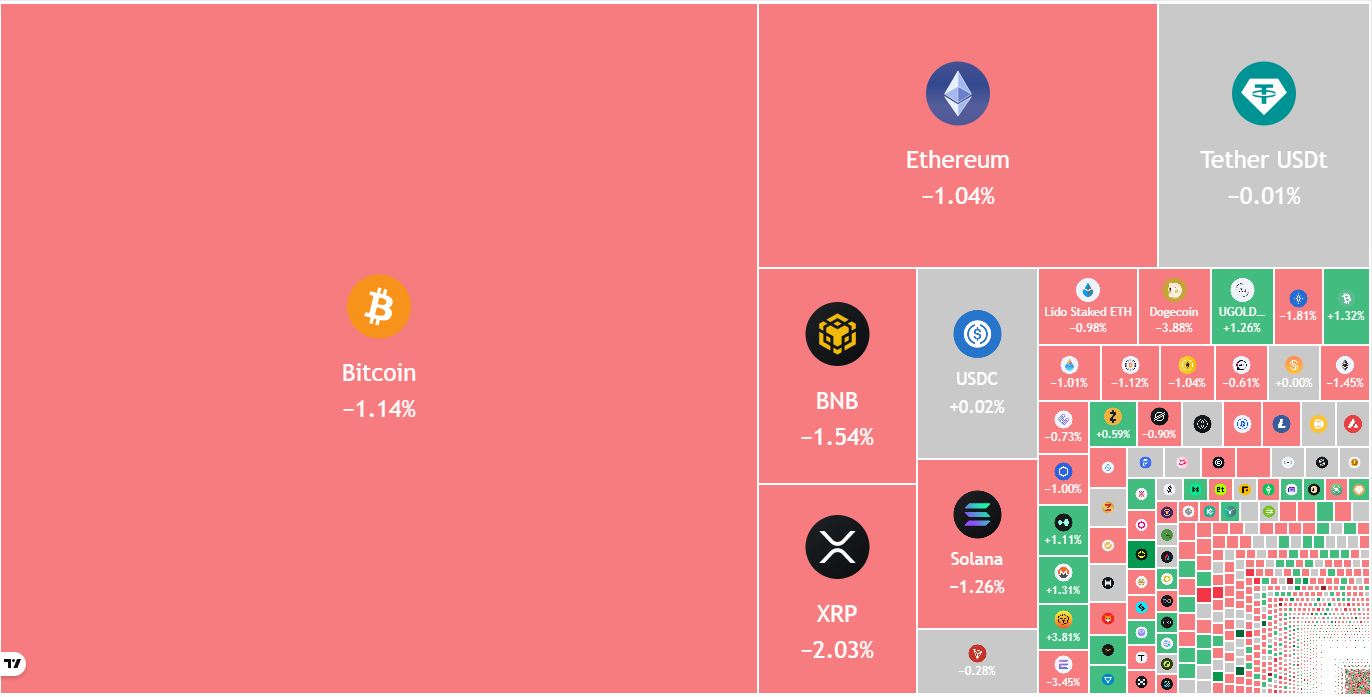

[Sideways price]: Bitcoin trades near 88,000 dollars, down about 7 percent for 2025 after weeks of tight range action.

[Options setup]: 10x Research highlights shrinking volatility and crowded options positioning as signs of pending large move.

"Flows from major holders, plus low volatility, set stage for sharp move," said 10x Research.

Does your car insurance cover what really matters?

Not all car insurance is created equal. Minimum liability coverage may keep you legal on the road, but it often won’t be enough to cover the full cost of an accident. Without proper limits, you could be left paying thousands out of pocket. The right policy ensures you and your finances are protected. Check out Money’s car insurance tool to get the coverage you actually need.

AI bubble risk threatens Bitcoin in 2026

Paolo Ardoino and other analysts see AI froth as major risk for crypto. Correlation with equities turns AI drawdown into direct hit for your portfolio.

[Bubble warning]: Nearly half of fund managers in a BofA survey call AI an asset bubble, with capex racing toward 500 billion dollars by 2026.

[Debt risk]: AI buildout leans on debt, raising risk for banks, private equity, and consumers if revenue lags.

[Bitcoin range]: Ardoino and research desks see Bitcoin dropping into 60,000 to 75,000 dollars with production cost near low 70,000s.

"AI shock in equities would drag on Bitcoin, though stronger institutional base should limit damage," said Ardoino.

Macro drag makes Bitcoin look like 2019

Benjamin Cowen sees parallels with 2019 while Bitcoin trails gold and stocks. He links progress to real liquidity, not simple optimism.

[Liquidity focus]: Stocks and gold respond to rate hopes, Bitcoin tracks real money flows instead.

[Low attention]: Sentiment stays muted, retail interest sits low compared with past cycle peaks.

[Cycle view]: Cowen still respects four year rhythm, tied to macro trends and labor data.

"Bitcoin needs clear liquidity support before strong outperformance," said Cowen.

Cowen urges focus on process over fast altcoin trades

He favors cycle awareness and risk control over short term price targets. Message for you, slow down and respect macro pressure into 2026.

[Long road]: Restrictive policy and weak labor trends still weigh on Bitcoin into 2026.

[Altcoin caution]: Cowen warns fast rotations into small caps reward traders less in tight liquidity.

"Treat cycles as a process, not a lottery ticket," said Cowen.

CAN YOU PREDICT THE PRICE?

HOW DID WE DO? 🤷

🚀Stay sharp. The path to $150K won't be linear🚀

This article is not financial advice. Market conditions can change rapidly, and past performance does not guarantee future results