- BitcoinZella

- Posts

- Fed liquidity, trade relief, and whale demand set stage for Bitcoin’s next move

Fed liquidity, trade relief, and whale demand set stage for Bitcoin’s next move

Fresh liquidity from the Federal Reserve, renewed U.S.–China cooperation, and whale accumulation point to a potential Bitcoin breakout. BTC remains range-bound but technical and macro signals lean bullish.

What we will talk about today...

Fed’s $29.4B liquidity boost signals quiet pivot

Bitcoin stalls near $112K despite bullish setup

BTC’s next move hinges on key support and moving averages

US–China trade deal sparks recovery hopes in crypto

The Federal Reserve added $29.4 billion through repo operations despite Powell’s “hawkish” tone. Analysts call it an early sign of policy easing.

Repo demand: At a five-year high, signaling dollar stress.

Liquidity effect: Past injections have triggered Bitcoin rallies.

BTC setup: Trading near $110K, consolidating before a possible move.

BREAKING: 🇺🇸 FED pumped $29 billion into the banking system yesterday, the highest ever in 5+ years.

It seems like Powell's hawkish talks were just a bluff.

— Ash Crypto (@Ashcryptoreal)

8:27 AM • Nov 1, 2025

“Liquidity injections always find their way into risk assets first. Bitcoin is no exception,” said a market strategist.

Bitcoin stalls near $112K despite bullish setup

Bitcoin’s breakout is stuck under a heavy supply zone, but whale demand is rising fast.

Resistance zone: 434,000 BTC held between $110K and $112.5K.

Whale signal: Large wallets turned net positive for the first time since August.

Pattern risk: A fall below $103.5K would hand control to sellers.

Wall Street Isn’t Warning You, But This Chart Might

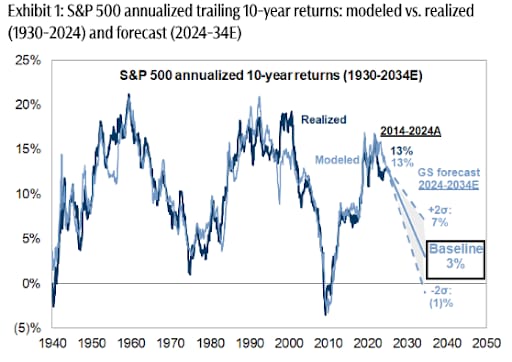

Vanguard just projected public markets may return only 5% annually over the next decade. In a 2024 report, Goldman Sachs forecasted the S&P 500 may return just 3% annually for the same time frame—stats that put current valuations in the 7th percentile of history.

Translation? The gains we’ve seen over the past few years might not continue for quite a while.

Meanwhile, another asset class—almost entirely uncorrelated to the S&P 500 historically—has overall outpaced it for decades (1995-2024), according to Masterworks data.

Masterworks lets everyday investors invest in shares of multimillion-dollar artworks by legends like Banksy, Basquiat, and Picasso.

And they’re not just buying. They’re exiting—with net annualized returns like 17.6%, 17.8%, and 21.5% among their 23 sales.*

Wall Street won’t talk about this. But the wealthy already are. Shares in new offerings can sell quickly but…

*Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

“Whales are reloading. That’s often the quiet start of a major leg up,” said an on-chain analyst.

BTC’s next move hinges on key support and moving averages

Bitcoin trades between its 100-day and 200-day moving averages, forming a clear equilibrium zone.

Support: $108K–$109K holds institutional demand.

Resistance: $114K–$116K caps upside until confirmed breakout.

Macro tailwind: Fed’s rate cut and U.S.–China cooperation support risk assets.

“As long as $109K holds, the structure stays bullish,” said CryptoVizArt analyst Shayan.

US–China trade deal sparks recovery hopes in crypto

The 2025 trade truce lifted the Crypto Fear & Greed Index from 33 to 37, signaling fading panic.

Tariff pause: U.S. tariffs suspended until 2026.

Market reaction: Analysts mark October 11 as the likely market bottom.

Sentiment: Bitcoin steady near $110K, early signs of confidence returning.

“Tariff relief brings back risk appetite. Crypto is usually the first to respond,” said MN Trading Capital founder Michael van de Poppe.

CAN YOU PREDICT THE PRICE?

HOW DID WE DO? 🤷

🚀Stay sharp. The path to $150K won't be linear🚀

This article is not financial advice. Market conditions can change rapidly, and past performance does not guarantee future results