- BitcoinZella

- Posts

- Bitcoin hits another record $73.6K

Bitcoin hits another record $73.6K

Get Smarter About Crypto

₿itcoin reached $73,152. +1.86%

♢Ethereum reached $4,053. +1.23%

What we will talk about today...

📈🚀 Bitcoin Skyrockets to New All-Time Highs of $73.6K Amidst Record ETF Inflows

🚀📈 El Salvador’s Bitcoin Strategy and Revenue Sources

📈🚀 Crypto Phishing Scams: A Rising Concern

Bitcoin Skyrockets to New All-Time Highs of $73.6K Amidst Record ETF Inflows

Bitcoin’s price continues to rise, reaching a new all-time high of $73,162. Even after a brief drop to $69,000, Bitcoin quickly recovered, setting new records and showing the market’s bullish trend.

📈Quick Recovery and Chart Analysis

The 1-hour BTC/USD chart shows a fast recovery, with Bitcoin reaching $73,679 on Bitstamp. Despite a temporary $4,000 dip from around $72,000, the market quickly rebounded. Resistance levels at $73,800 temporarily slowed the rise, but the path seems clear for Bitcoin to reach $80,000.

BTC liquidation heatmap (screenshot). Source: CoinGlass

🔄Clearing Overleveraged Longs

Trader Jelle notes that Bitcoin cleared overleveraged long positions, retested the 2021 cycle high, and quickly bounced back to $72,000. This suggests a favorable environment for further price increases.

💼Institutional Money Inflows

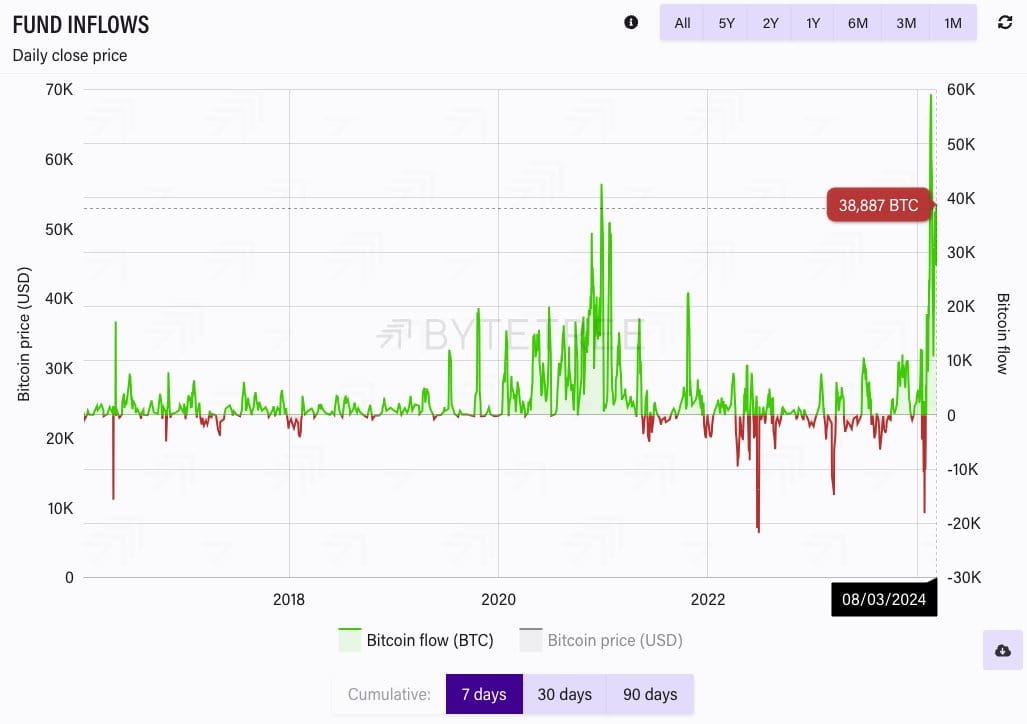

Financial commentator Tedtalksmacro points out a significant influx of institutional money into Bitcoin, especially through new spot Bitcoin ETFs in the U.S. He suggests that this record-breaking inflow marks a major shift, making 2020’s inflows seem small. He predicts that Bitcoin’s price will continue to rise towards $100,000, but advises caution as historically, peak inflows are followed by a 2-3 month window to exit the market.

Bitcoin fund inflows.

📊ETF Inflows Break Records

Spot Bitcoin ETFs saw a historic $1 billion net inflow on March 12, led by BlackRock’s iShares Bitcoin Trust. BitMEX Research notes a record inflow of 14,706 BTC that day, a significant part of the newly mined supply in 2024, which totals around 65,500 BTC. The combined holdings of the two largest ETFs from BlackRock and Fidelity exceed 330,000 BTC as of March 13, more than five times the amount added by miners.

Bitcoin spot ETF cumulative inflows.

As Bitcoin continues its impressive run, driven by institutional interest and ETF inflows, the cryptocurrency market is evolving in unprecedented ways, paving the way for future developments. 🌐📈

WHAT WE RECOMMEND😉

Do you want To Get More Info about Crypto? Check these out.💎All Completely FREE✅

|

El Salvador’s President Nayib Bukele has hinted that the country’s Bitcoin holdings might be more than what’s known. El Salvador, which adopted Bitcoin as legal tender in September 2021, is not just gaining from its Bitcoin reserves but also earning from various Bitcoin-related sources.

📈Bitcoin-Related Earnings

El Salvador is profiting from its Bitcoin adoption in many ways. These include earnings from its passport program, converting BTC to USD for local businesses, mining income, and use in government services. This shows El Salvador’s commitment to integrating Bitcoin into its economy.

💼Undisclosed Bitcoin Holdings

While some Bitcoin purchases by El Salvador are known, President Bukele has suggested there might be more. He had announced daily Bitcoin purchases in November 2022 but didn’t give details. Current estimates value El Salvador’s Bitcoin reserves at over $202 million, helped by Bitcoin’s recent price surge to $71,234.

📊Online Tracker and Comments

The online Nayib Bukele Portfolio Tracker is used to estimate El Salvador’s Bitcoin holdings. But President Bukele has suggested the country might have more Bitcoin than the tracker shows. Stacy Herbert, head of El Salvador’s National Bitcoin Office, said the government is earning Bitcoin in various ways, including the successful Freedom Passport program.

+ #BTC revenue from our passport program

+ Revenue from converting #BTC to USD for local businesses

+ #BTC from mining

+ #BTC revenue from government services— Nayib Bukele (@nayibbukele)

10:55 PM • Mar 11, 2024

🌐Bitcoin’s Role in El Salvador’s Economy

The National Bitcoin Office reaffirmed El Salvador’s commitment to Bitcoin, saying, “El Salvador is Bitcoin Country. We have been stacking sats in many ways. For two and a half years now.” Ambassador Milena Mayorga highlighted the country’s readiness for the future economy, backed by modern Digital Assets and Bitcoin Laws.

🚀Future Plans

President Bukele confirmed last month that El Salvador won’t sell its Bitcoin, emphasizing that “1 BTC = 1 BTC.” Plans to launch Bitcoin-backed bonds, build Bitcoin City, and offer passports to investors contributing $1 million in BTC show the government’s ambitious plans.

As El Salvador continues to lead in the crypto world, its innovative approach to Bitcoin adoption and use is unfolding, showing a unique model that goes beyond traditional cryptocurrency landscapes. 🌍🔗

Crypto Phishing Scams: A Rising Concern

In February, the crypto world saw a worrying rise in phishing scams. Scammers tricked around 57,000 users, stealing nearly $47 million, as per Scam Sniffer data. They used phishing tricks to make users give up their digital assets.

💔Losses in February

February 15 was a dark day, with scammers taking more than $6 million. This day was the worst for crypto users and the best for criminals in the month.

🎭Fake Social Media Accounts

Despite warnings, many fell for scams through bogus social media accounts. These accounts, pretending to be popular Web3 projects, fooled users and led to huge losses.

🧵 [4/6] Most victims were lured to phishing websites through phishing comments from impersonated Twitter accounts.

— Scam Sniffer | Web3 Anti-Scam (@realScamSniffer)

9:29 AM • Mar 10, 2024

🌐Scam Targets

Most scams targeted the Ethereum chain, making up 78% of all incidents. ERC-20 tokens, common on Ethereum, were the main targets, making up 86% of stolen assets. Scammers often use phishing signatures like Permit, Increase Allowance, and Uniswap Permit2.

📊Losses by Chain

Ethereum Mainnet: 78% of total thefts. Arbitrum: Nearly $3.5 million lost. BNB Chain: Losses around $2.5 million. Polygon and Optimism: Made up the top five, with losses of around $1.8 million and $1.4 million, respectively.

🕵️♂️Scammers’ Tactics

The report reveals a worrying method used by scammers. After stealing assets, they used safe wallets or “account abstraction” wallets as their token approval spenders. This allowed them to drain users’ funds, showing their sophisticated and adaptable methods.

As the crypto world deals with these phishing scams, it’s crucial to stay aware and use strong security measures. In the ever-changing world of digital finance, vigilance is key. 🔒🌐

CAN YOU PREDICT THE PRICE?

HOW DID WE DO? 🤷

Stay tuned for more twists and turns in the crypto world & Happy Investing🚀💎