- BitcoinZella

- Posts

- Bitcoin Faces Pressure as Markets Await Key Data and Whale Activity Returns

Bitcoin Faces Pressure as Markets Await Key Data and Whale Activity Returns

Bitcoin struggles to stay above $110,000 while traders eye U.S. inflation data and early holders move old coins, adding volatility to an already tense market.

What we will talk about today...

Worst Uptober in Years? Bitcoin Risks First Red October Since 2018

ChatGPT’s Bitcoin Strategy Ahead of U.S. CPI Data

Satoshi-Era Bitcoin Wallet Awakens After 14.4 Years

Bitcoin trades flat after early highs, raising concern that October could close negative for the first time in seven years.

[Performance Drop]: Bitcoin is down about 2.3% for the month, far below its typical 20% average October gain.

[Historical Context]: In past bull years like 2017 and 2021, Bitcoin rose over 40% in October.

[Market Outlook]: A 4% drop from here would mark Bitcoin’s worst October since 2013.

“Uptober hangs in the balance,” said analyst Timothy Peterson. “Sixty percent of Bitcoin’s annual performance usually comes after October 3.”

THIS IS THE WORST UPTOBER EVER.

The only worse one was 2014 (-13%).

2013: +60%

2017: +50%

2021: +40%

2025: -4%Bad Uptober usually means one thing: MOONVEMBER.

— Rekt Fencer (@rektfencer)

9:46 PM • Oct 23, 2025

Wall Street Isn’t Warning You, But This Chart Might

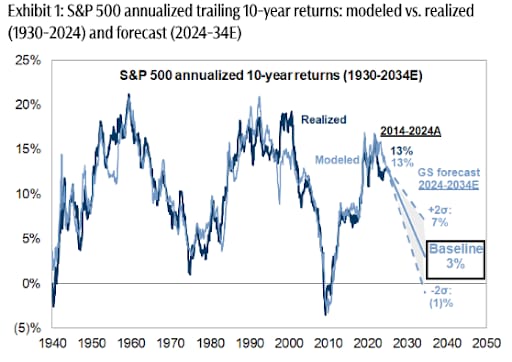

Vanguard just projected public markets may return only 5% annually over the next decade. In a 2024 report, Goldman Sachs forecasted the S&P 500 may return just 3% annually for the same time frame—stats that put current valuations in the 7th percentile of history.

Translation? The gains we’ve seen over the past few years might not continue for quite a while.

Meanwhile, another asset class—almost entirely uncorrelated to the S&P 500 historically—has overall outpaced it for decades (1995-2024), according to Masterworks data.

Masterworks lets everyday investors invest in shares of multimillion-dollar artworks by legends like Banksy, Basquiat, and Picasso.

And they’re not just buying. They’re exiting—with net annualized returns like 17.6%, 17.8%, and 21.5% among their 23 sales.*

Wall Street won’t talk about this. But the wealthy already are. Shares in new offerings can sell quickly but…

*Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

ChatGPT’s Bitcoin Strategy Ahead of U.S. CPI Data

Traders brace for the U.S. inflation report, which could dictate short-term moves for Bitcoin.

[Market Setup]: Bitcoin holds between $107,000 and $111,000 as traders wait for the CPI release.

[AI Advice]: ChatGPT suggests cutting leverage and hedging with short-term puts before the data hits.

[Reaction Plan]: A hotter CPI could hurt BTC as yields rise, while a softer reading might spark a rebound.

“You are walking into this CPI with sentiment tilted, not settled,” wrote analyst Shilpa Lama. “The smarter play here is balance.”

Satoshi-Era Bitcoin Wallet Awakens After 14.4 Years

A long-dormant wallet linked to Bitcoin’s earliest days has moved 4,000 BTC worth about $440 million.

A Satoshi-era wallet containing 4,000 $BTC ($440.4M) has moved 150 $BTC, worth $16.56M, to a new wallet after being dormant for 14.4 years.

Additionally, the whale has been selling $BTC for a long time through another wallet, which also received 4,000 $BTC + 50 $BTC directly

— Onchain Lens (@OnchainLens)

12:25 AM • Oct 24, 2025

[Wallet Details]: The address dates back to 2009–2011, when Bitcoin’s creator was still active online.

[Whale Moves]: The coins appear to be transferring to another wallet that has already been selling.

[Market Impact]: Analysts say whale sales are adding resistance near the $110,000 level.

“OG whales are creating sell pressure,” said analyst James Check. “These moves often weigh on short-term price action.”

CAN YOU PREDICT THE PRICE?

HOW DID WE DO? 🤷

🚀Stay sharp. The path to $150K won't be linear🚀

This article is not financial advice. Market conditions can change rapidly, and past performance does not guarantee future results